Share Now

Every parent dreams of a better future for their children. One that is filled with exciting opportunities and promising possibilities. One way to start is to plan for their education. When you start saving and investing early, you can reduce the burden of paying expensive tuition fees or taking on debts just for their higher education.

There are 4 main reasons why you need to plan for your children’s education:

- Increasing tuition fee. You cannot prevent this but you can certainly prepare for it by securing your savings.

- In case of premature death of the child’s parents. Have peace of mind by knowing that when an unforseen death by accident or health conditions happen to you or your partner, your child will still continue to sustain his or her education in the future.

- To be financially prepared for enrollment. When you commit to a savings program you will be confident to pay for your child’s tuition fee when the actual time for enrollment comes. No need to feel the pressure of finding finances because you already planned for it ahead.

- You’ll put your savings in the right investment vehicle for education. When you simply combine all your finances in one savings account, it might be withdrawed little by little over time. So by planning early, you’ll be able to invest in an education insurance which specifically ensures savings for your child’s education.

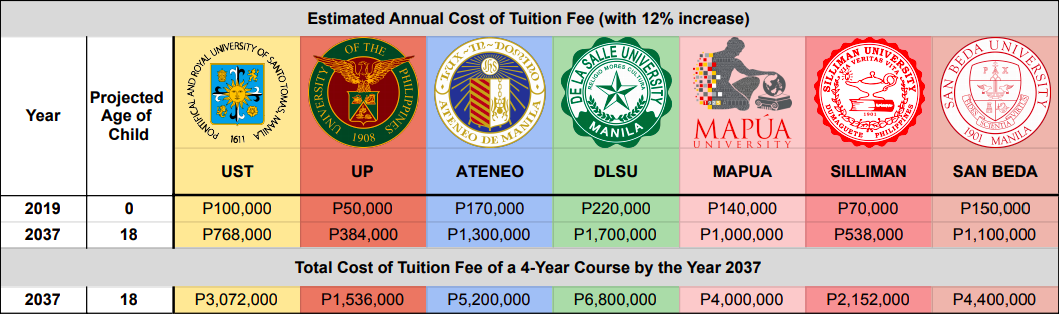

The average tuition fee in the Philippines for private colleges and universities according to the Commission on Higher Education (CHED) increases by 12-percent annually. When a baby is born in 2019, he or she will enter first year in college when he or she reaches 18 years old and that is by the year 2037. If the average tuition fee in 2019 is P140,000 per year, by the time he or she enters college and we apply the average percentage of a tuition fee increase, the price will already hike up to P1,000,000 per year in 2037.

To give you a clear view of the estimated cost of tuition, here is a list of the top universities in the Philippines with their average tuition fee per year and the amount that they will potentially reach by the time your children will enter college, given the average percentage increase.

Upon multiplying the above tuition fee in the year 2037 by 4 while simultaneously applying the 12-percent increase by each year, the total cost of a 4-year college course becomes more intimidating and almost impossible to imagine.

However, if you start saving money as early as your child is born you will have more security for their future. Or when you choose to avail educational insurance for them early, you will have a longer time to grow your savings and investments. As a parent, ask yourself “will you have the money to send your child to a proper school?” If you are having doubts and worries, you should think about putting your money into investments so while you are preparing for the expenses they’ll need for school, your money can potentially grow and be secured in a trusted insurance company of your choice.

There are also factors why parents were not able to invest for their child’s education and here are some of the common reasons why:

- They don’t have the money to invest or to save. Most likely an average Filipino family only earns enough to supply their daily needs like food, shelter, house rent, electricity bills, and water bills. But adjusting some priorities can help you save money like canceling unnecessary subscriptions for entertainment or avoiding eating out to restaurants all the time, and you can find the extra money each month to allocate for your savings.

- They don’t know where to invest their money. Consulting a financial service provider or a financial advisor for recommendations would be a good way. You can discuss options from a traditional savings account to education insurance.

- Thinking their child will get a college scholarship. Scholarships are a great help for a student but not everyone is granted one. You still need to consider if he or she will pass the requirements and even upon getting one there are still miscellaneous fees to cover in their entire college years like food expenses, transportation, lodging, books, uniforms, and projects.

Because of the above mentioned, some parents suffer the financial problems of affording education when the time finally comes for their child to enroll in college. As a consequence, the burden is then passed on to the child instead because to be able to provide financial support for themselves they often turn to be a working student to pay for their own tuition fees, rely on their relatives’ support, desperately apply for a scholarship, or take on student loans which they will eventually pay continuously upon graduating.

Considering all of these, the child’s possibilities and options will now be limited. You can be taking away from them the freedom to pursue the courses that they are passionate about or the choice of picking a good university. The pressure on them will now be heavier because of the need to balance study and making sure that they can continue to do so. And as a parent, that is something you will never wish for your children but rather the best possible education that will guide them to a bright future.

Start saving for your children’s future today. Get in touch with one of our financial advisors now.

What do you want to do next?

Mica is the president of Aetos Financial. She has been a financial advisor for more than 9 years. She is committed to provide quality financial services to her clients.