Share Now

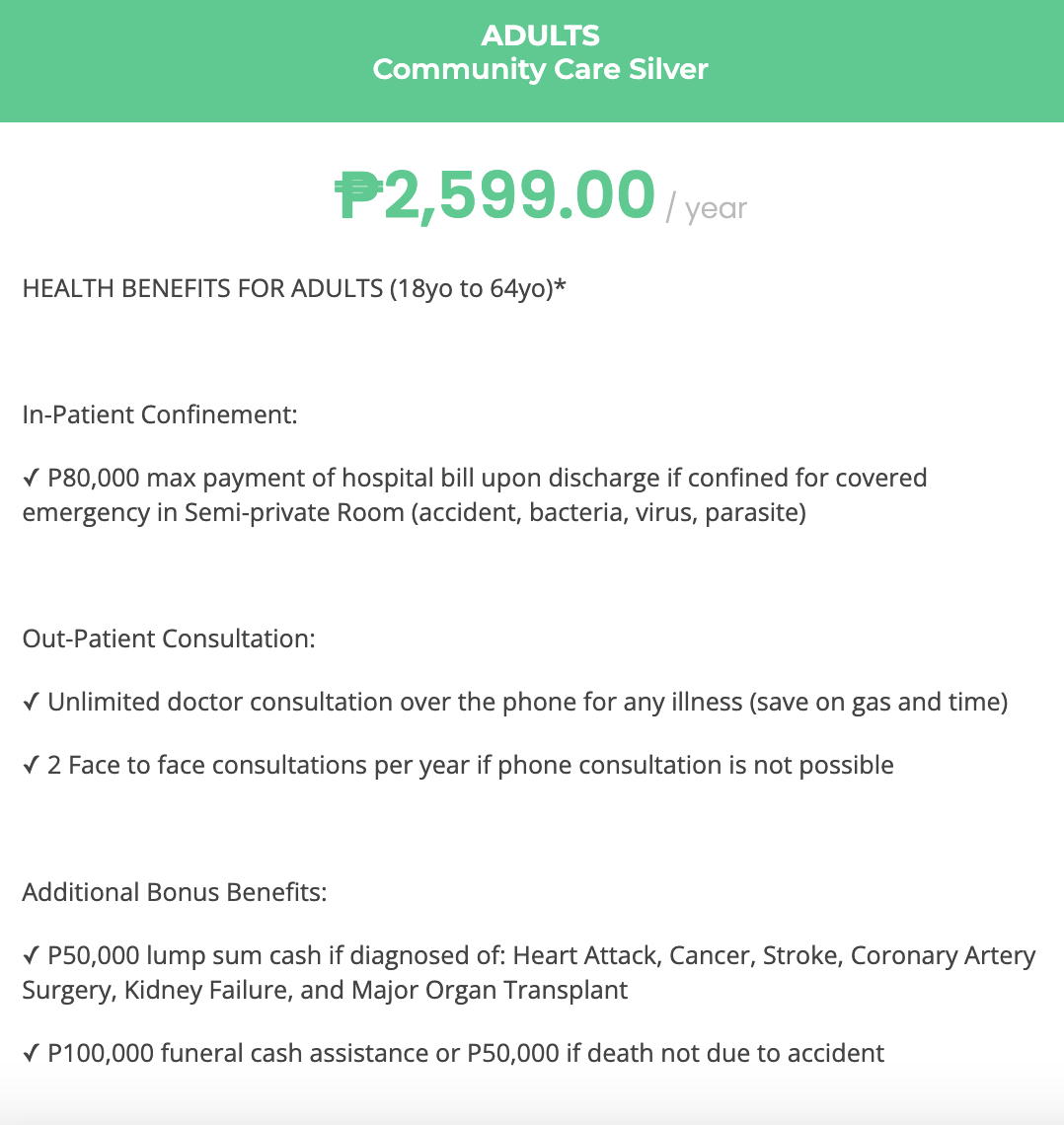

With the rising cost of hospitalization, we realized the importance of having a health card or an HMO. Because for as low as P1,750.00 per year, we can be covered for 1 year. The demand for these products creates income opportunities for individuals who would like to be an HMO Agent.

For those interested in being an HMO Agent, here are the 3 easy steps

- Apply as an HMO Agent of an insurance agency accredited by an HMO company.

Our company Aetos for example is currently hiring part time and full time health card sales agents. To apply as an HMO Agent of Aetos Financial, take the Are You Fit To Be A Financial Advisor Quiz by clicking here.As an HMO sales agent/advisor you can sell products like these:

- Wait for the company to call you for an interview

The company will get in touch with you to schedule you for an interview. During the interview, you can also ask questions about selling health cards. - Once accepted to sell health cards, complete the licensing requirements

a. Take the required training to start selling

b. Submit documentary requirements such as copies of your valid IDs

FOR THOSE JOINING OUR TEAM AT AETOS FINANCIAL YOU MAY ALSO SELL:

For clients who do not want a lifetime paying health cards (pay every year to be covered), companies like Manulife offer a 5yr to pay and 10yr to pay health coverage. Once you complete the paying period, you will be covered until age 100.

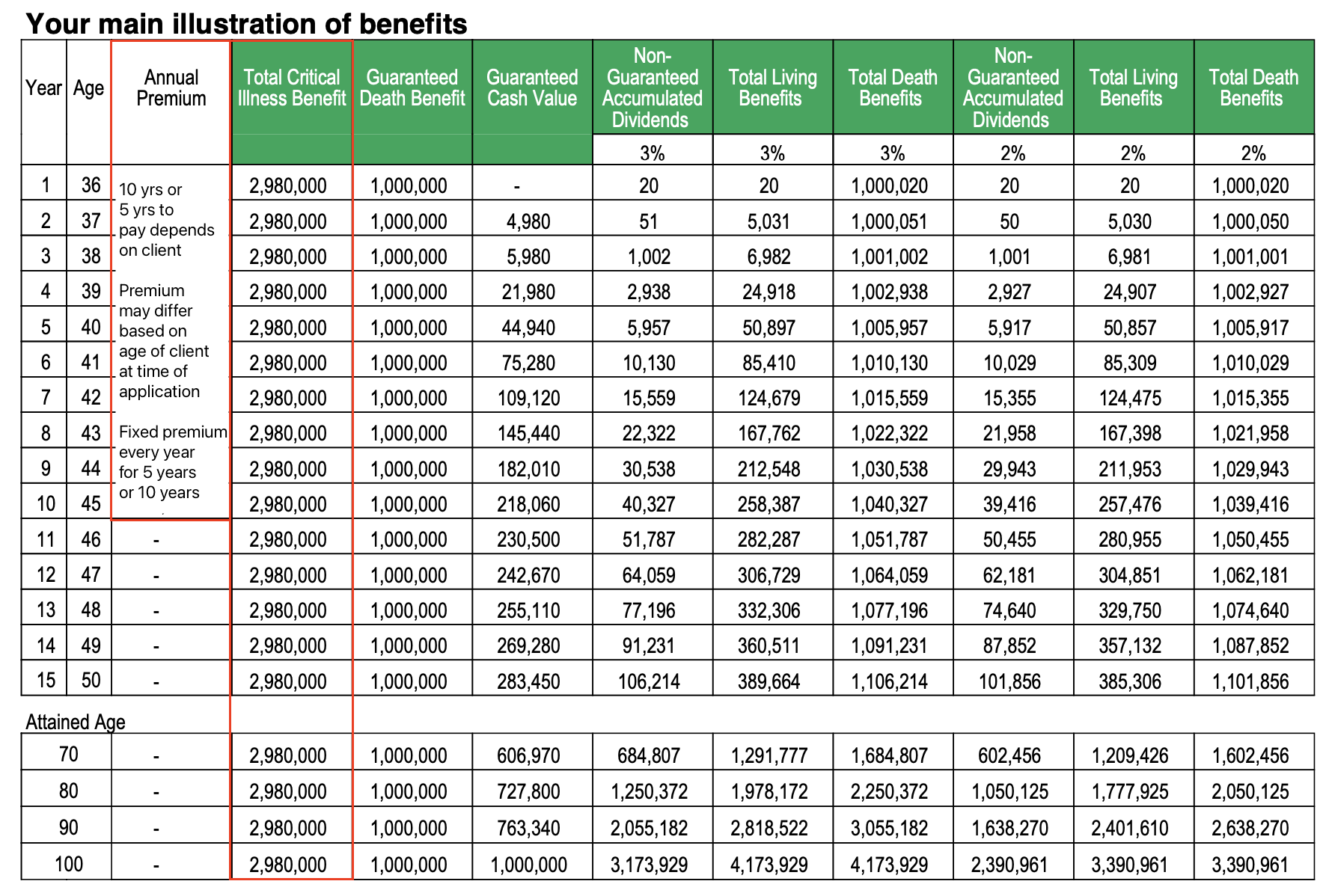

An example of this proposal from Manulife is as follows:

To explain the Manulife Health + Life proposal above:

1. Client pays for 5 or 10 yrs, and after completion of the paying period, guaranteed stop payment

2. Client gets covered until age 100

3. If the client gets diagnosed with a covered critical illness, the client receives up to P2.98M

4. If the client dies, the family gets P1M

5. If the client terminates the policy after a few years, the client gets the guaranteed cash values PLUS the non-guaranteed dividends

If you want to Join Aetos to offer health cards and be an HMO agent, you need take the Are You Fit To Be A Financial Advisor Quiz now.

ABOUT THE AUTHOR

Mark Fernandez, CPA, RFC, AFA, CWP, CEPP started as an insurance agent/financial advisor right after graduation at age 22 while working as an auditor at SGV&Co (Ernst & Young). He worked as a part-time financial advisor for six months before going full-time. Despite having no insurance background or connections, he became a Million Dollar Round Table member (MDRT) at age 23 due to his perseverance to learn more about the world of investing and insurance. He is currently a life (at least 10 years MDRT) and qualifying member of the MDRT and is a 2022 Top of the Table Member. He is the founder of Aetos Financial Insurance Agency Inc, which has its head office in Makati. Aetos was the Top 1 in terms of FYP and Top 5 in APE in life insurance agency rankings nationwide in 2021. Currently, Aetos has operations and financial advisors in Luzon, Visayas, and Mindanao. He is currently completing his master’s degree at the Asian Institute of Management. You may reach us by calling Aetos Financial Office Landline at 02-8789-9128 or contacting our Hotline at 0905-FINANCE or 0905-3462623.

What do you want to do next?

Aetos Financial