What is a UITF (Unit Investment Trust Fund)?

It is a way to save money and an alternative to normal bank savings. A UITF acts like a savings program where you put a one-time investment (minimum P1000). You are not required to add additional investments after, but you may.

How much can I earn if I invest in UITF?

The possible return ranges from 4% to 30% per year, depending on the type of investment fund chosen. You can choose to invest in the stock market, bonds, real estate investment trust, bonds or money market.

How much is the minimum investment?

The amount can vary. For peso it is P1,000 to open an account or $1000 USD for dollar accounts.

How much do I need to pay every month after opening an account?

You are not required to pay per month. Additional investments are optional but highly enccouraged.

How to open a UITF Account (How to get a Manulife Account Number)

*Applying for UITF account is fast and easy. It can be done in less than 15 minutes.

- Application is done online. Before you go to the website, please prepare the three (3) needed documents as required by the Bangko Sentral ng Pilipinas (BSP) and Manulife to prevent financial fraud:

- Identification Document (ID) – A picture or scanned copy of your Philippine government-issued identification document

- Residential Address Proof – A picture of a document with your name and mailing address on it, like credit card statement, bank statement, electricity bill, water bill, telco bill (or any document available to verify that you live at that address)

- Bank Account Proof – Screenshot of online banking app or bank statement that shows your name and account number (blur other sensitive info, need confirmation of correct bank account number in case you withdraw funds)

- Open Google Chrome on your cellphone and go to bit.ly/manulifeuitf

- If asked for a wealth specialist code, use code of your agent or if you don’t have an agent use the code of Agent Mark Fernandez 375705

- Schedule a meeting with your agent and If asked if you had a meeting to discuss UITF in the application form, please answer yes

- Please take note to indicate the correct wealth specialist/agent code so that your agent can see your account and give you correct financial recommendations

- Once you have answered the questions, please text your agent/financial advisor so your agent can review and activate your account. If you don’t have an agent/financial advisor you may email aetos@companysupport.net or text Agent Mark Fernandez at 09914314388.

- Once activated, you will receive a Manulife Investment Account Number, which you can use to make a bills payment to pay your investment.

How to pay your investment (you need to have a Manulife Account Number to do this)?

- Log-in to www.manulifeim.com.ph

- Click transact.

- Click subscription.

- Choose the type of fund and click INVEST button (suggested funds are: global dynamic leaders (invested in the international stock market and no monthly payout) or global multi asset fund (with monthly payout) ).

- Indicate one one-time investment. (If you do not know which fund is best for you, contact your agent).

- If you wish to do a regular monthly investment (regular savings plan) you may also indicate the amount.

- Choose Bills Payment

- Open the mobile app of your bank. Choose bills payment in your bank’s mobile app (available for BDO, BPI, Metrobank, Security Bank, Union Bank, or Maya). Or you can also go to any bank branch of BDO, BPI, Metrobank, Securitybank or Unionbank to make a face to face bills payment.

- Take a screenshot of a successful bills payment and follow the instructions in the website.

- Input the debit date (the date when you paid the bills payment)

- Upload your proof of bank account (any bank document or screenshot that has your name and bank account number in it just in case you want to withdraw your money in the future)

- Wait for an email that your deposit was received by Manulife.

VERY IMPORTANT: If no email confirmation received within 24 hours, please subscribe again. It means the process was not correctly done.

There are so many funds that I can invest in Manulife, which one should I choose?

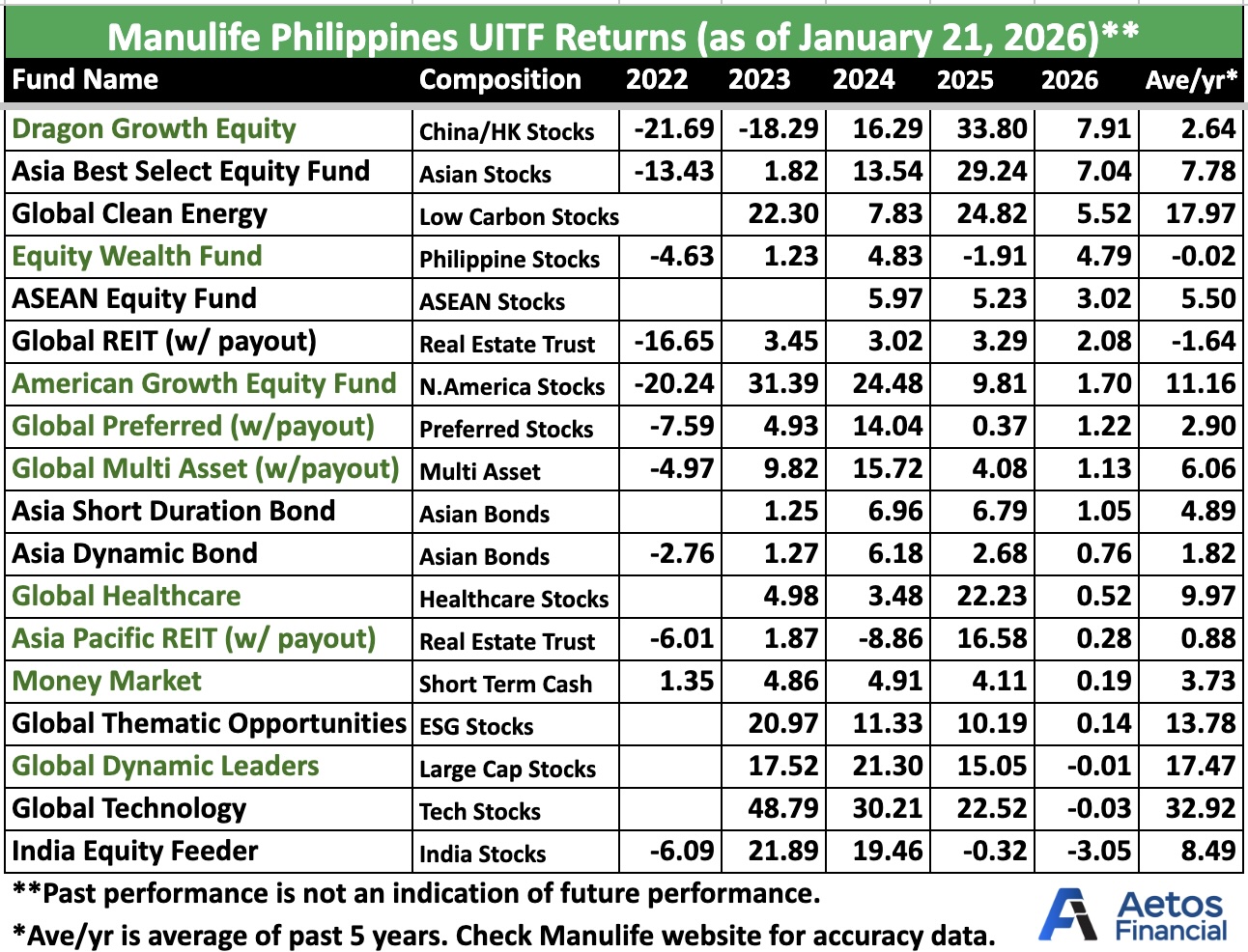

It depends on your risk profile (high risk/high return), the table below shows the different possible investment funds and the yearly historical returns. Some funds give high returns every year but can also have a negative return which is scary for some investors. Some funds do not have a negative return but the yearly return is very low. Some funds have monthly payouts which can be deposited to your bank account, some have funds have no payouts. You may contact your agent for advice. These are the available Fund Name Options: For more info of the fund above go to: bit.ly/aetosuitf

For more info of the fund above go to: bit.ly/aetosuitf

I am already contributing monthly in the UITF but I want to increase my regular monthly contribution next month, how do I do it?

You are not required to do a monthly contribution but it is recommended. If you are already doing a monthly contribution and want to increase it, simply follow the same instructions above but do not anymore put an amount for the initial investment, just simply edit the amount in the regular monthly investment. For example you want to increase your monthly contribution from P1000 per month to P2000 per month indicate:

How can I check my investment if it has grown already?

You may contact your agent or go direclty to www.manulifeim.com.ph and log-in to see the current value of your investments.

If you have questions on the process feel free to call your agent or email aetos@companysupport.net or call 09914314388.