Share Now

Recently, several of our financial advisors have encountered some information in the internet saying that buy term invest the difference is way better than VUL. We have been hearing a lot of misconceptions about VUL in the past but maybe now is the right time to answer the question: Which is the best way to get a life insurance via BTID or VUL?

To recap, VUL or Variable Universal Life is a kind of life insurance that combines investment and protection all in one. Meaning you do not have to go to two companies to get these benefits – less hassle in applying and monitoring. On the other hand, BTID or buy term invest the difference is a form of investing where you get the life insurance from another company and investment from another company. You then withdraw the money from the mutual fund to pay for the life insurance premiums every year.

One of our financial advisors sent a link of the website of Vince Rapisura as follows: https://vincerapisura.com/btid-vul-comparison-presentation/ and his video at https://www.youtube.com/watch?v=N1fRUciAX5I that basically discourages people to get a VUL and instead go for BTID. So let us see if the allegations hold water in reality.

Let us dissect if the facts stated in those websites are really true. The Slide #1 below was taken from: https://vincerapisura.com/btid-vul-comparison-presentation/

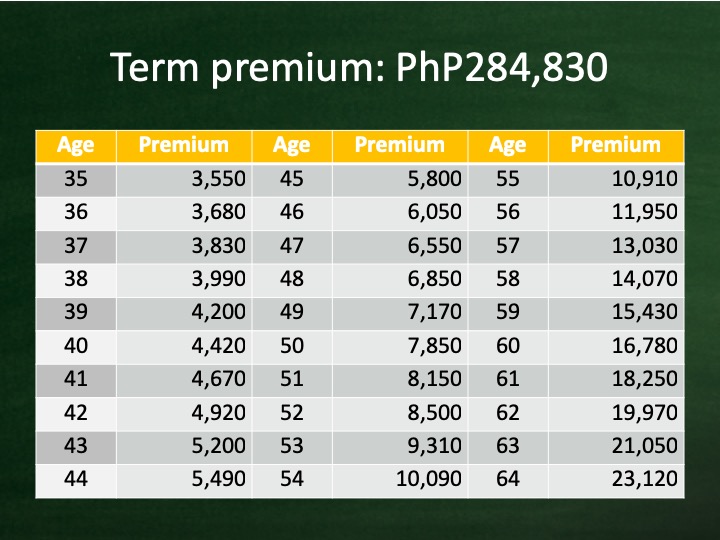

The website states that to be insured for P1 Million pesos you only need to pay P3,550 per year at age 35 increasing every year until age 64 at P23,120. We don’t know which company Mr. Vince Rapisura got this quotation but let us assume that this is the case.

SLIDE #1

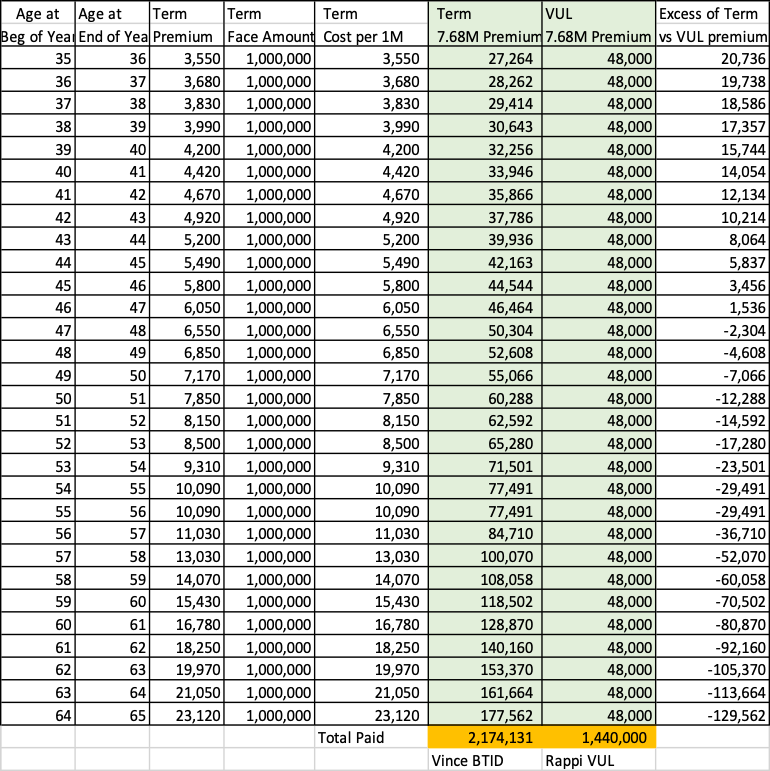

Let us assume that there are two people namely Vince and Rappi planning to be insured. Both individuals have P48,000 to give every year for insurance and want to be covered at P7.68M (the highest coverage possible for the VUL).

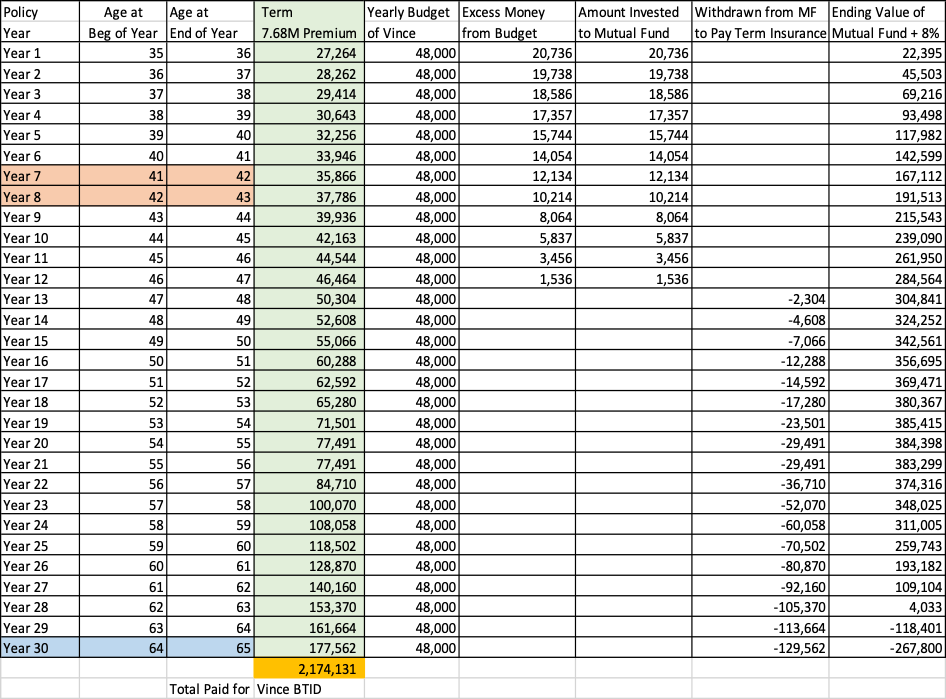

(1) Vince’s strategy is BTID: He bought a term insurance for P27,264 premium (computed as P1M coverage at P3,550, then converted to P7.68M) at age 35 and increasing yearly up to P177,562 premium at age 64 (as stated below at column 6). Vince then invests the remaining balance from his P48,000 budget in a mutual fund.

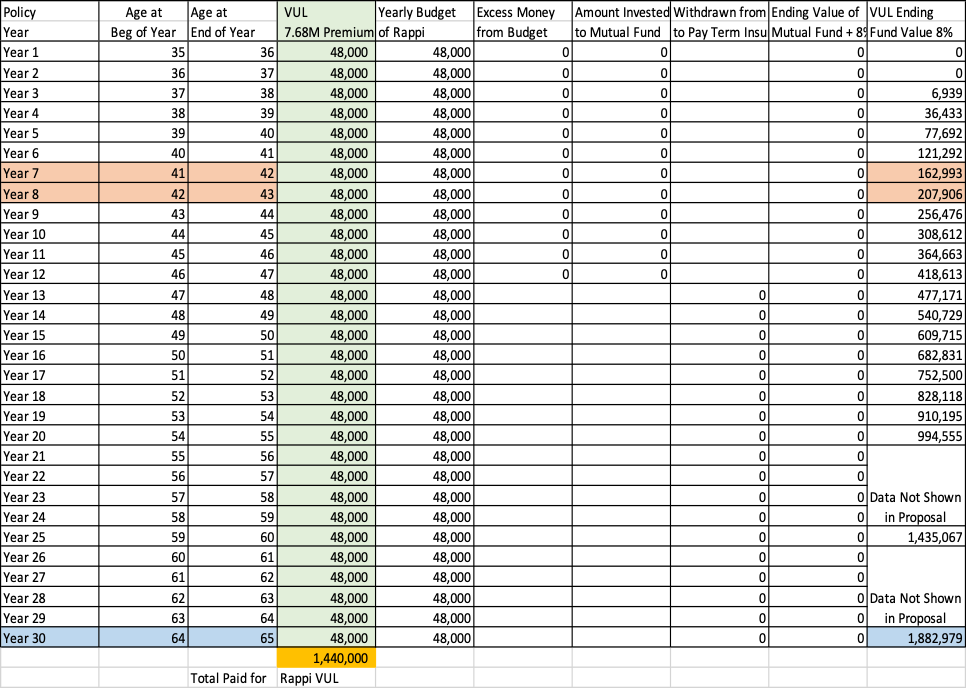

(2) Rappi’s strategy is VUL: He bought a VUL and paid P48,000 per year fixed until age 64.

The Table below shows the differences in strategy of Mr. Vince (Column 6) and Mr. Rappi (Column 7):

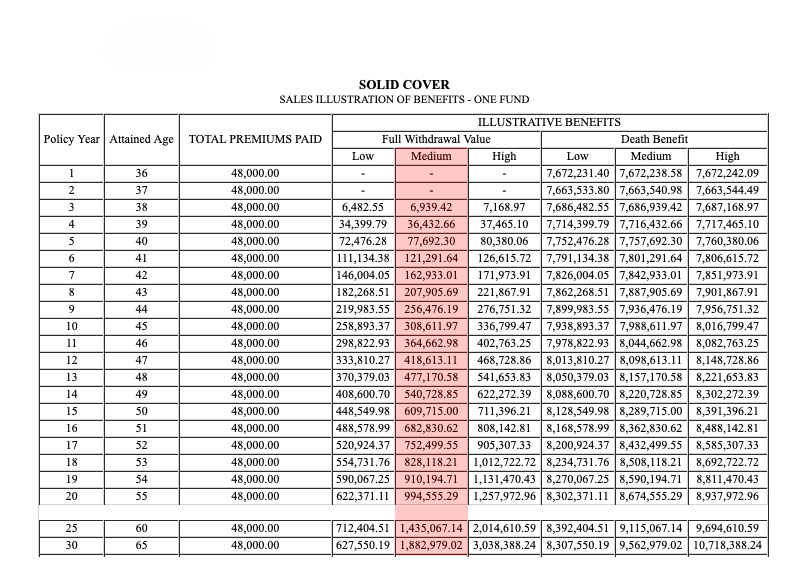

We got a sample proposal for the VUL and here is the actual proposal for a P48,000 per year at P7.68M coverage:

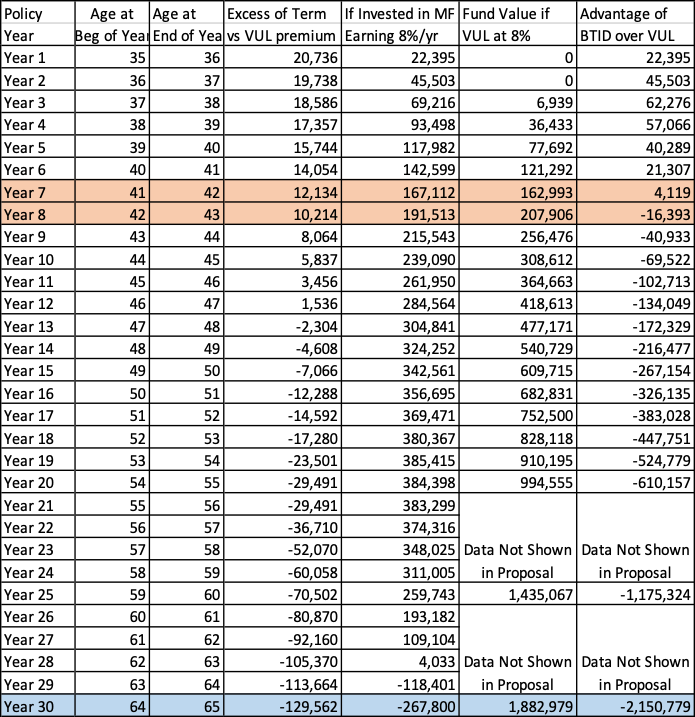

In the table below, we see that after Year 1, the mutual fund of Vince is now at P22,395 (Column 5 Below) while VUL has no fund value yet. However at year 8, we see that the mutual fund of Vince is now at P191,513 (Column 5) while Rappi’s VUL fund is now at 207,906 (Column 6). This puts the VUL at an advantage than BTID moving forward (Column 7).

Based on the table above you will see that from Year 1 to Year 7, BTID has more advantages than VUL (See Column 7). However, from Year 8 to Year 30 you will see that VUL has more benefits than BTID. In fact at age 65 the fund value of the VUL will be at P1,882,979 (Column 6 Table Above) versus a negative fund value of P267,800 with BTID (Column 5 Table Above). Meaning after paying P48,000 for 30 years you will be able to withdraw P1,882,979 from the fund value of the VUL (At Both 8% Average Return).

In Summary:

Vince who got a separate mutual fund and life insurance using BTID. Will withdraw the funds from mutual fund in the future to pay the life insurance premiums:

Total Coverage = P7.68M fixed + mutual fund value

Total Premiums Paid: P2,174,131 (Column 4, Table Below)

Fund Value after age 65: none in fact would have a debt or negative fund value of -P267,800 (Column 9, Table Below)

VINCE’S DETAILED ANALYSIS OF TERM INSURANCE STRATEGY:

======

Rappi who got a VUL – life insurance + protection all in one. No need to withdraw the funds to pay for the life insurance premiums:

Total Coverage = P7.68M increasing every year

Total Premiums Paid: P1,440,000 (Column 4, Table Below)

Fund Value after age 65 (at 8% assumed return): P1,882,979 (Column 9, Table Below)

Total excess of fund value over premiums paid: P1,882,979-1,440,000 = P442,979

RAPPI’S DETAILED ANALYSIS OF VUL STRATEGY:

AND THE WINNER IS?

Well both sides have advantages and disadvantages. If the insured plans to be insured only for less than 8 years maybe BTID is the right thing to do. Although it is more inconvenient because you need to monitor two companies for your insurance and your investment.

However, if you plan to live until age 65 or more then VUL is the right choice to go.

What are the benefits of going for term insurance strategy (BTID)?

- Affordable Insurance Premium in the first 8 years (based on table above)

What are the disadvantages of term insurance strategy (BTID)?

- Increasing Insurance Premium

- No fund value after 65 years

- High probability that you will forget to withdraw from your mutual fund to pay your premiums

- Termporary, limited Coverage (usually until 65 to 70 years old only)

- No Estate Tax benefits on investment side

What are the benefits of going for VUL strategy?

- Fixed premium payments every year

- High fund value at age 65 = P1,882,979 (based on table above)

- Convenience, no need to withdraw the premiums to every year from your mutual fund

- May cover until age 100

- Tax benefits on both life insurance and investment

What are the disadvantages of VUL strategy?

- Higher premiums on the first 7 to 8 years compared to term insurance

One important thing to note when investing in VUL is that if you want more insurance, you will have lesser fund value. If you want more fund value you have to reduce your insurance. The key is to have a balance between insurance and fund value when it comes to VUL. Talk to a financial advisor to be able to know more about this.

If you have questions or cannot understand properly the information above, feel free to get in touch with us. We would be glad to explain.

Resources: Supporting Excel File Computation

What do you want to do next?

Aetos Financial