Share Now

This article is about the compensation of financial advisors. If you want to be a financial advisor take the “Are You Fit To Be A Financial Advisor Quiz” now.

Last Update of this Blog: March 10, 2024

The job of being a financial advisor in the Philippines is quite different from other advanced countries. In other countries, financial advisors are paid consultancy fees for giving money advise.

In the Philippines however, financial advisors earn through commissions for selling products since most Filipinos will not pay for consultancy fees on financial advise given to them.

For those wanting to be financial advisors, one of the considerations is whether the company you are applying to be a financial advisor provides the highest commission per sale.

For example, if you will be employed would you choose to work for a company that gives P100,000 per month vs only P50,000 per month for the same level of effort? Most likely you would go for the highest offer. Aside from compensation, financial advisors also look at the kind of products being sold if they are sellable to their target clients.

Before this blog was written we took a research among all major life insurance companies in the Philippines to determine which life insurance company provides the highest commission for financial advisors. And here is the result of our research:

Based on our research this company (Company A) provides 45% commission. If the agent meets certain parameters the commission goes up to 65%. However, if the amount paid by the client per year is less than 30k per year, the commission drops to 10% to 20% of the amount paid by the client, instead of 45%. Here’s an quick computation:

1. Large Sale: P100,000 paid by the client – commission is at P45,000 (can become P65,000 if the agent was able to meet parameters)

2. Small Sale: P20,000 per year paid by the client – commission is at P2,000 (20%)

Another company called Manulife Philippines gives 40% commission on the amount paid by the client. If the financial advisor is able to meet parameters the commission becomes 60%. Here’s a quick computation

1. Large Sale: P100,000 paid by the client the commissions is at P40,000 (can become P60,000 if the agent meets the parameters)

2. Small Sale: P20,000 per year paid by the client – commission is at P2,500 (25%)

So which company provides better commissions is it Company A or Manulife?

The answer is on the trail commissions. Manulife provides a trail commission of 0.30% of the total value of your clients investments (including investment earnings).

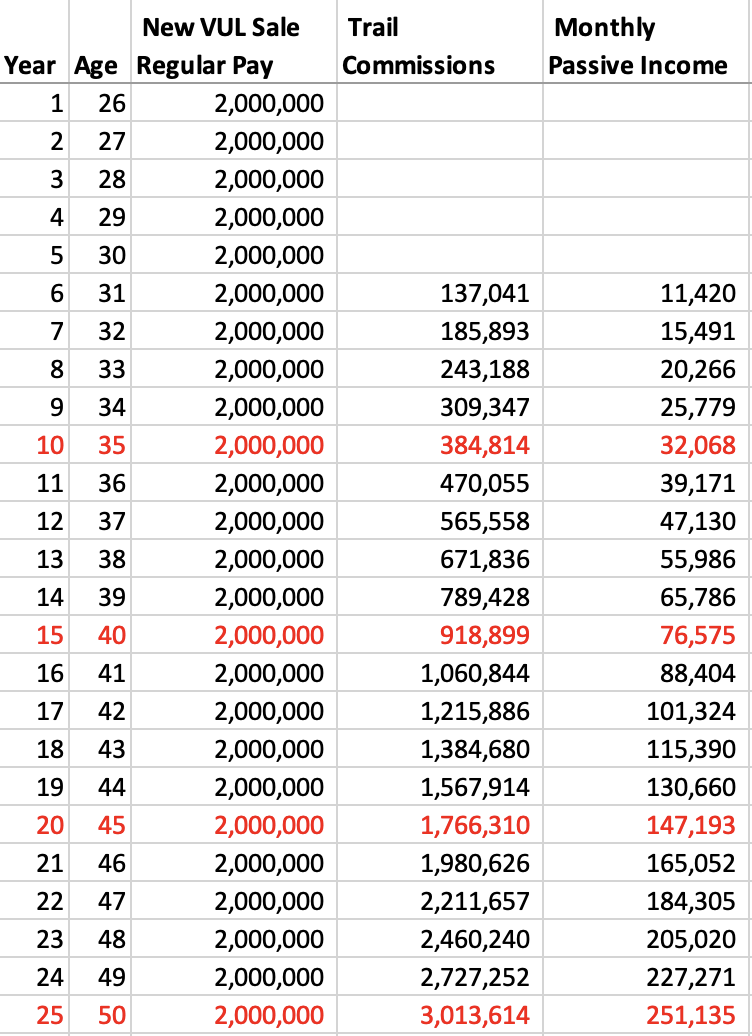

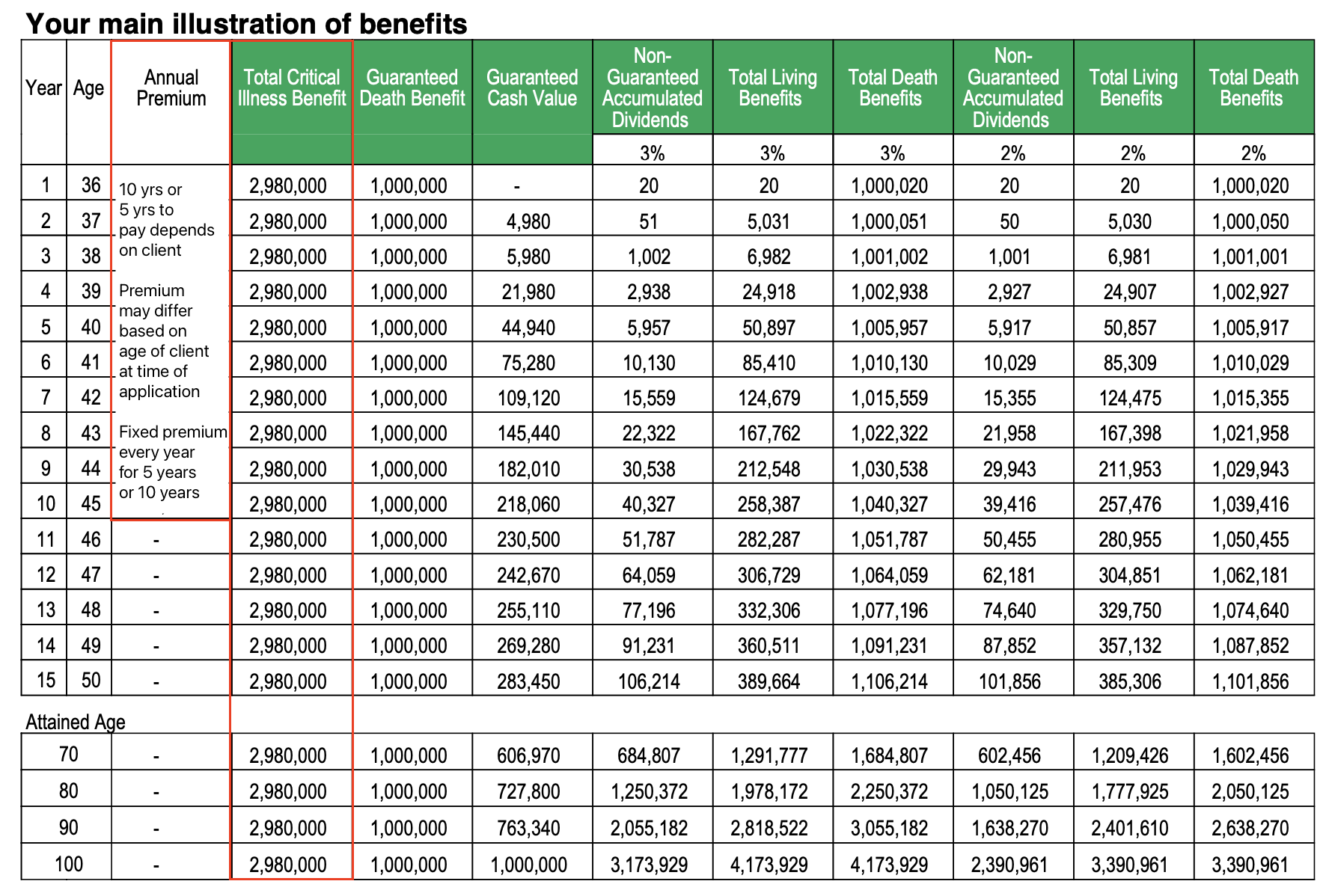

For example if you join Manulife at age 25 this is the projected trail commissions that you will earn per year and per month:

As you can see, starting the 6th year of being a financial advisor in Manulife, you will get an estimated passive income from trail commissions of P137,000 per year and goes up to:

10th year – P384,814 per year

15th year – P918,899 per year

25th year – P3,013,614 per year and so on

Why are trail commissions important?

This is because prices of goods and services are increasing every year and there are times when you do not have a sale for that month. For example, some financial advisors take a month long vacation abroad with family. The trail commissions gives the financial advisor additional income even if the advisor was not able to sell for that month (since trail commissions are given every month). Further it also allows the advisor to have increasing income for being loyal to the insurance company they are working with.

Additional benefits on top of the agent’s commission for qualified producing advisors:

*Company retirement pension benefits

*On top of what Manulife gives, Aetos Financial Insurance Agency also gives free health card for producing advisors (Inpatient, Outpatient, Consultation, Life Insurance, Critical Illness)

*Trip Incentives – Local (Boracay, Palawan, etc) , International (US, Europe, etc)

*And more!

AETOS ADVISORS CAN SELL OTHER PRODUCTS:

Aside from being able to sell life insurance from Manulife here are other products that we can offer:

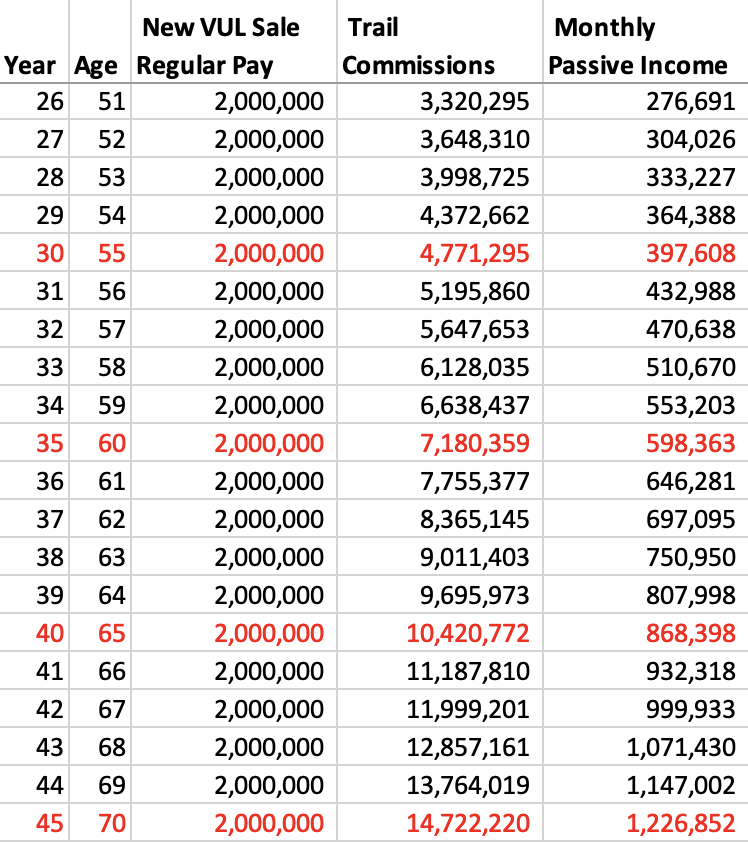

- UITFs and Mutual Funds – Some clients have short term goals like saving for a car or in the next 2 to 3 years. Life insurance products cannot cater to this need as there are insurance charges for life insurance based investments. Only pure investment products like UITFs and Manulife can cater to this need (no insurance charges and no early withdrawal fees).

- Health Card from Pacific Cross, Philcare, etc. – Commission rate is as high up to 15% every year

- Car, Property and other Non Life Insurance from Malayan, Pioneer, Standard and Pioneer – Commission rate is also competitively high

- Group Insurance – Sell an insurance policy with only one company master policy for all employees (minimum 5 employees per company) which is much cheaper than individual plans. Manulife also gives high commission rates for group insurance sales.

*If you invested P1,000 in Manulife’s Global Tech Fund in January 2023, it could have grown to P1,349.70 by July 5, 2023.

ARE THE PRODUCTS GOOD?

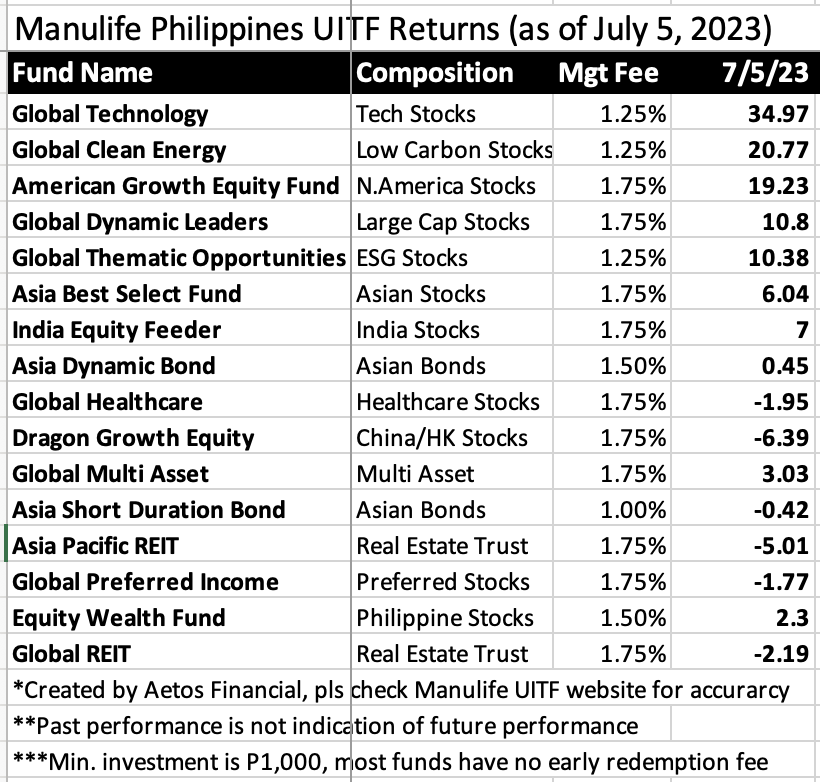

Another question potential financial advisors would ask is, are the products good enough? With Manulife, the answer is a big yes for two main reasons. They cover until age 100 when most companies cover only until age 65. For example this health coverage is until age 100:

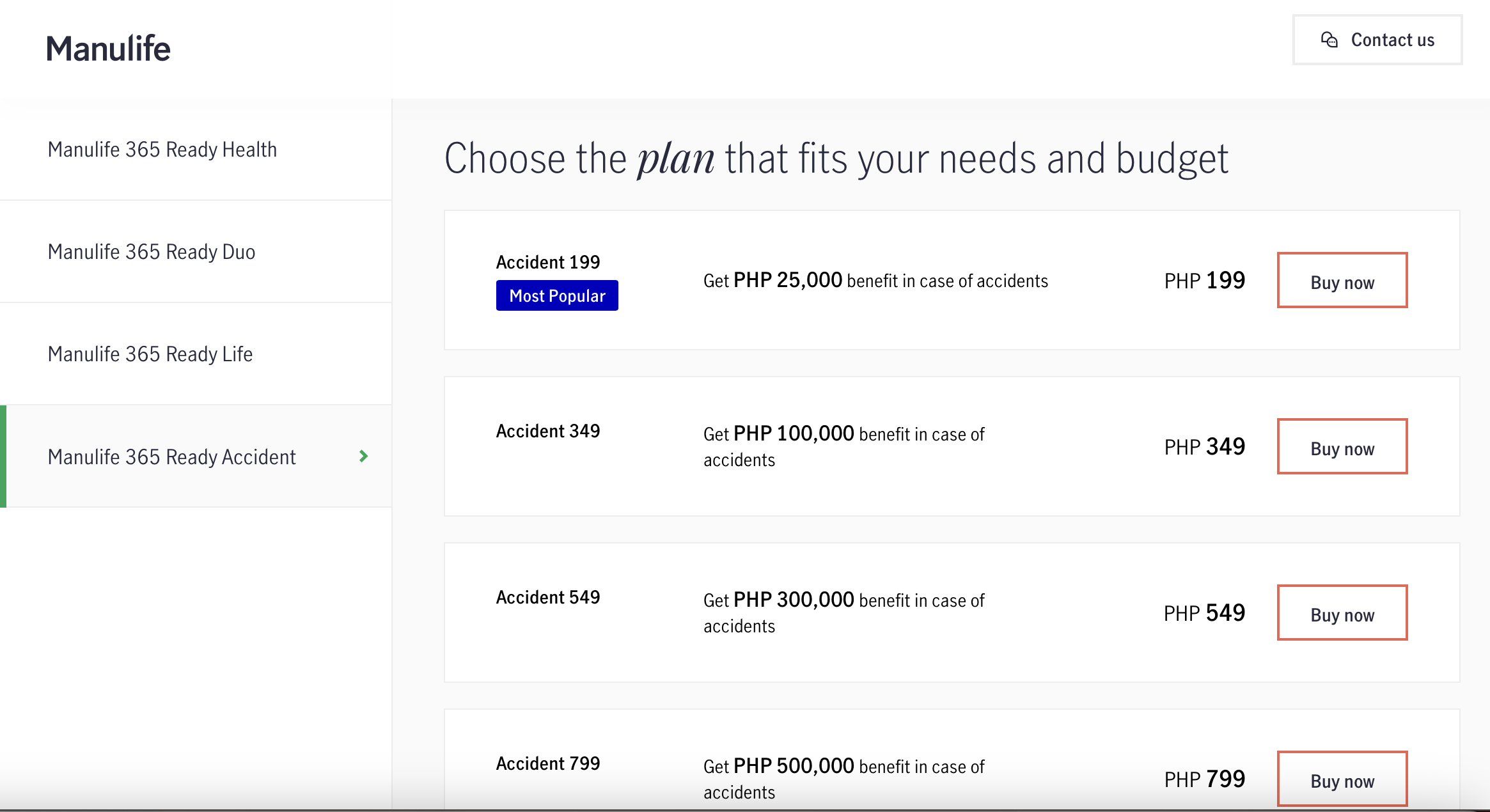

Manulife also caters to high end and low end clients because their products are very affordable. Imagine for as low as P199 per year, your clients can already get insured.

IS MANULIFE A STABLE COMPANY?

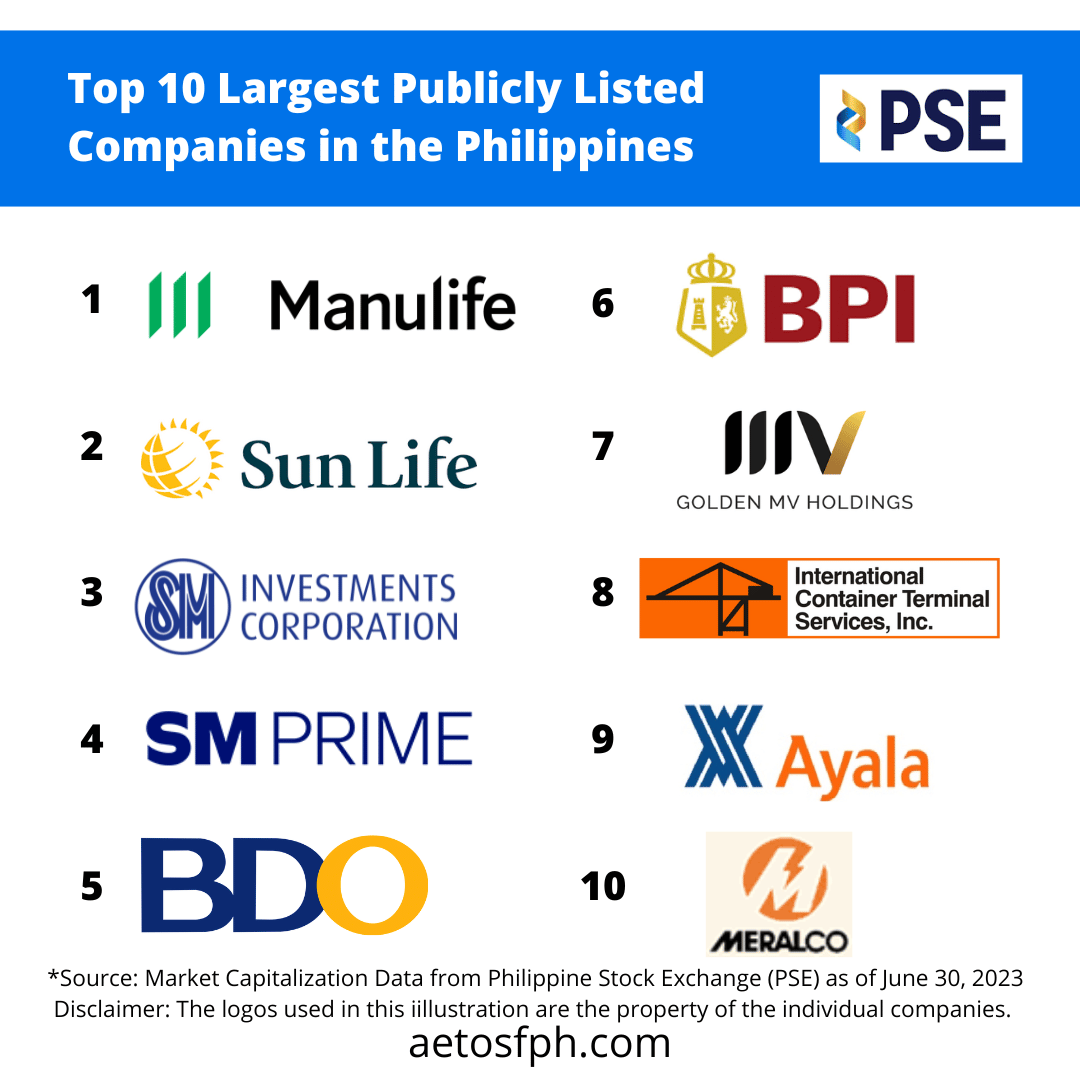

Manulife is the largest Canadian life insurance company in Canada and also the largest publicly listed company in the Philippines based on the data from Philippine Stock Exchange:

HIGH RISK HIGH RETURN JOB

It could be tempting to say that Insurance Agents are earnings so much. However, note that the life of an insurance agent is brought about by many rejections and frustrations. In order to make 1 sale you need to talk to as much as 10 people especially if you are inexperienced.

First advisors do not earn a fixed salary essentially making them no work no pay. It is just reasonable to earn more than regular employees or else there will be no reason for people to shift to this profession. Second, unlike other sales jobs like real estate or car sales where there is usually no obligation after the product has been sold, being a financial advisor is different. Thus, if the client got a life insurance policy, this means that the agent will need to keep reminding clients for due dates, assist client on their concerns and answer their questions for as long as the client is alive. Imagine if the client is age 25 now and is expected to live until age 80. This means that the financial advisor is bound to serve the agent for the next 55 years!

The commission rates for insurance agents may look big on the onset but it entails a lot of responsibility to take care of the client until the client essentially dies where the agent will also help in the claims process and coordination with the beneficiaries upon their death or sickness.

So at the end of the day, being a financial advisor is like having a business. You have to have that entrepreneurial spirit. Indeed, it is the highest paying hard work and the lowest paying easy work – and either way you choose your income.

CONCLUSION

As you can see Manulife could be considered one of the best life insurance companies in the Philippines. You can read more about Manulife here.

If you want to check out the compensation and benefits of being an Financial Advisor or want to create a General Agency just like Aetos Financial then please contact us.

ABOUT THE AUTHOR:

Mark Fernandez, CPA, RFC, AFA, CWP, CEPP started as an insurance agent/financial advisor right after graduation at age 22 while working as an auditor at SGV&Co (Ernst & Young). He worked as a part-time financial advisor for six months before going full-time. Despite having no insurance background or connections, he became a Million Dollar Round Table member (MDRT) at age 23 due to his perseverance to learn more about the world of investing and insurance. He is currently a life (at least 10 years MDRT) and qualifying member of the MDRT and is a 2022 Top of the Table Member. He is the founder of Aetos Financial Insurance Agency Inc, which has its head office in Makati. Aetos was the Top 1 in terms of FYP and Top 5 in APE in life insurance agency rankings nationwide in 2021. Currently, Aetos has operations and financial advisors in Luzon, Visayas, and Mindanao. He is currently completing his master’s degree at the Asian Institute of Management. You may reach us by calling Aetos Financial Office Landline at 02-8789-9128 or contacting our Hotline at 0905-FINANCE or 0905-3462623.

What do you want to do next?

Aetos Financial