Share Now

When I started as an advisor, right after college, being an insurance agent/financial advisor was not yet a popular career. There were only a few advisors that you could find. More than ten years later, a sudden shift happened. Younger financial advisors are joining. Most insurance companies are doing their best to attract the best talents to be one of their financial advisors. With all the advertisements on recruitment that you can find online, you may be wondering which insurance company is the best for you. In reality, it is hard to say which is the best. In fact, my choice of which company to join could have been different. But we made a simple guide on how to choose the best insurance company and the best team for you:

1. Compensation and other benefits

One of the reasons I wanted to be an advisor is the unlimited income it offers. When choosing which company to join, you should ask yourself if they are paying their advisors WELL for every sale they make. What I love most in the company I am in now regarding compensation is the TRAIL COMMISSIONS.

So how does it work? For more than 10 years, I have been working as a financial advisor, I estimate the total fund value of the investments plus earnings of my clients could reach around 1 Billion Pesos now. The trail commission at Manulife is around 0.30% of your active clients’ total unwithdrawn investment value. This means that even if I did not sell insurance or investments, I could have a passive income of around 3 Million Pesos per year.

Unfortunately, I did not start my career at Manulife. I only thought about how good it was later in my career. So I do not receive a passive income of P3M per year yet (Sayang I should have started with Manulife). But for you who are still starting a career as a financial advisor, please consider the long-term compensation of the company you will be working for. Find a company that gives you good passive income. You do not want to keep selling insurance and investments forever. It would help if you also had passive income from your sales.

Another compensation to look for is the overall bonuses given. For example, companies like Manulife give a bonus of as much as 55% of the quarterly income of the financial advisor. For example, if the commission rate is 40%, then a 55% bonus would mean an additional 22% (40% x 55%), making the commission rate a high of 62%. This is just the first year commission, every time your clients continue paying their insurance you will also have commissions thereafter.

For those looking to become insurance sales managers, consider a company that rewards their managers. A thing to look for are companies where the managers are properly compensated for recruiting and training their financial advisors. Some companies easily spin off their advisors from their managers in a short period which is not good for those seeking a good income from being a manager of their financial advisors.

For more information about which company provides the highest commission for financial advisors, click here.

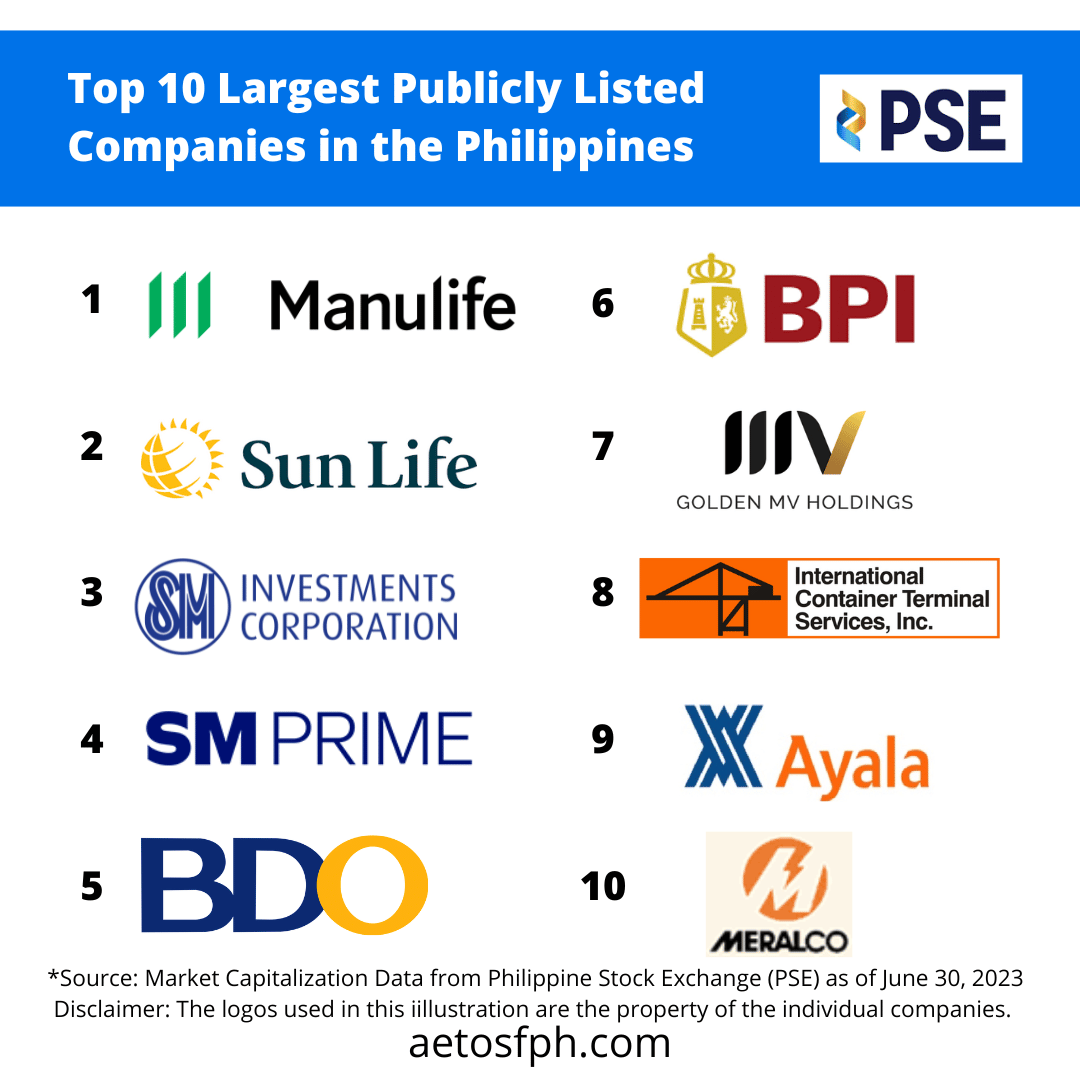

2. Brand Recognition & Stability of the Company

In this age of global digital marketing, you need to work for a company known not just in the Philippines but also abroad. Imagine if you will be selling to an OFW. If you are selling for a company that is known in the country they are working, you would have a higher chance of closing the sale when they come to the Philippines.

I also suggest you choose a large life insurance company because it is easier to sell to the public if it is a large company.

3. Ability to Offer Other Products, not just Insurance

3. Ability to Offer Other Products, not just Insurance

In my 14+ years as a financial advisor, some clients wanted shorter-term investments. For example, some clients approached me because they wanted to save for their downpayment for a house or save to start a new business. Unfortunately, I had to turn down those clients because before working with Manulife, we at our previous company only offered investments with life insurance. There were no pure investment products.

If we can only offer insurance-based products, we cannot be called complete financial advisors because, in reality, some clients do not need life insurance. Some just need a pure investment product. Even if we say that the product being offered has very minimal life insurance, the fact that there is some insurance to it would mean lesser returns than a pure investment product.

4. Minimal Fees for products being offered

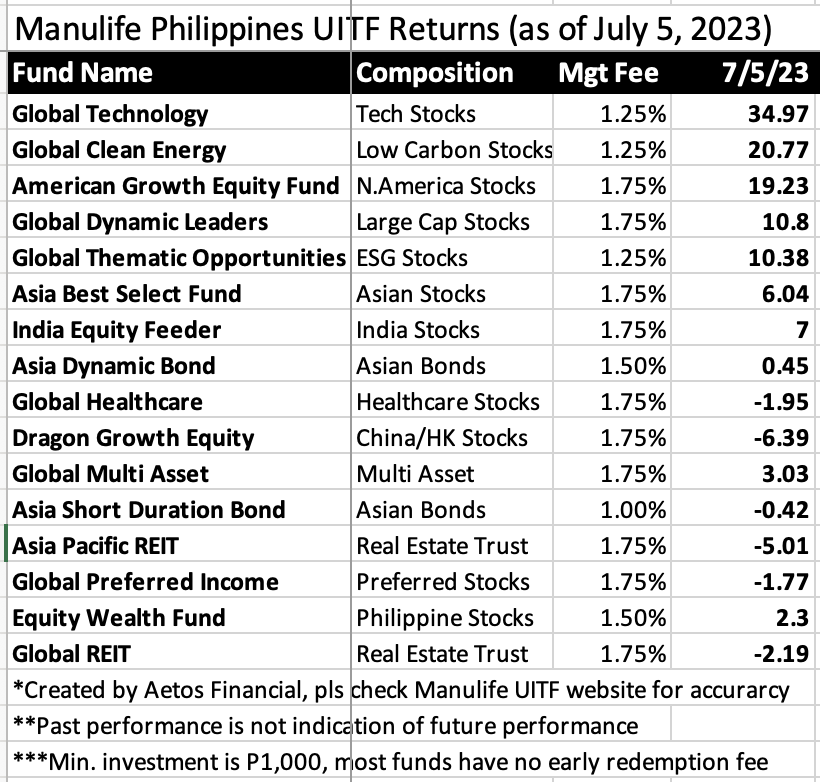

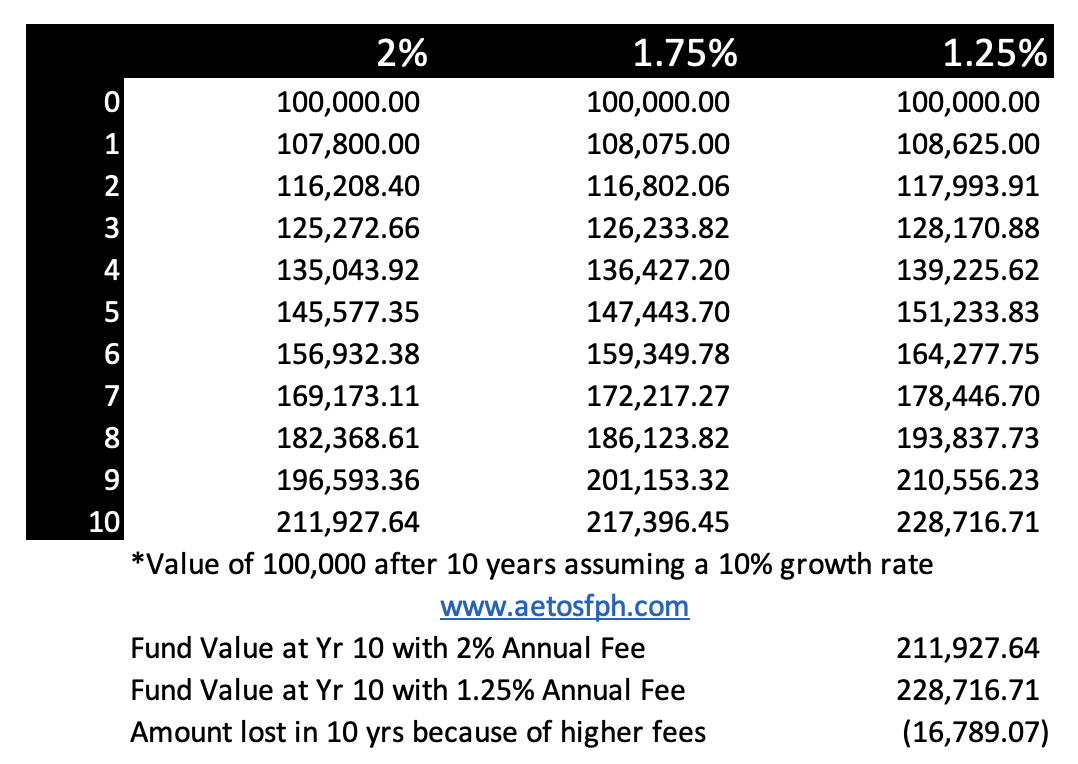

One of the reasons why investments can have small returns is because the investment has a high fund management fee. Just imagine an investment being charged a 2% annual fund management fee vs. 1.75% will have a significant difference in returns:

Looking at the data above, if you invest your P100,000, it will be P211,927.64 at a 2% annual fund management fee vs. P228,716.71 at a 1.25% annual fund management fee. This is a difference of P16,789.07, which the client could have saved had the client invested in a fund with lesser fund management fees.

Another thing to consider is hidden fund management fees. Some companies say that they have only, say, 1.5% fund management fees, but there are layers to it. For example, the investment or insurance company is not the main fund manager and has a tie-up with other companies on their investments. That is why it is important to always ask before investing: “Who is the main fund manager of this investment?” It is possible that such a company is not the main fund manager and they are just outsourcing the fund from another company, and the main fund manager is also charging a fund management fee before it is distributed to the investment or insurance company. The multiple layers of fund management fees will reduce investment returns.

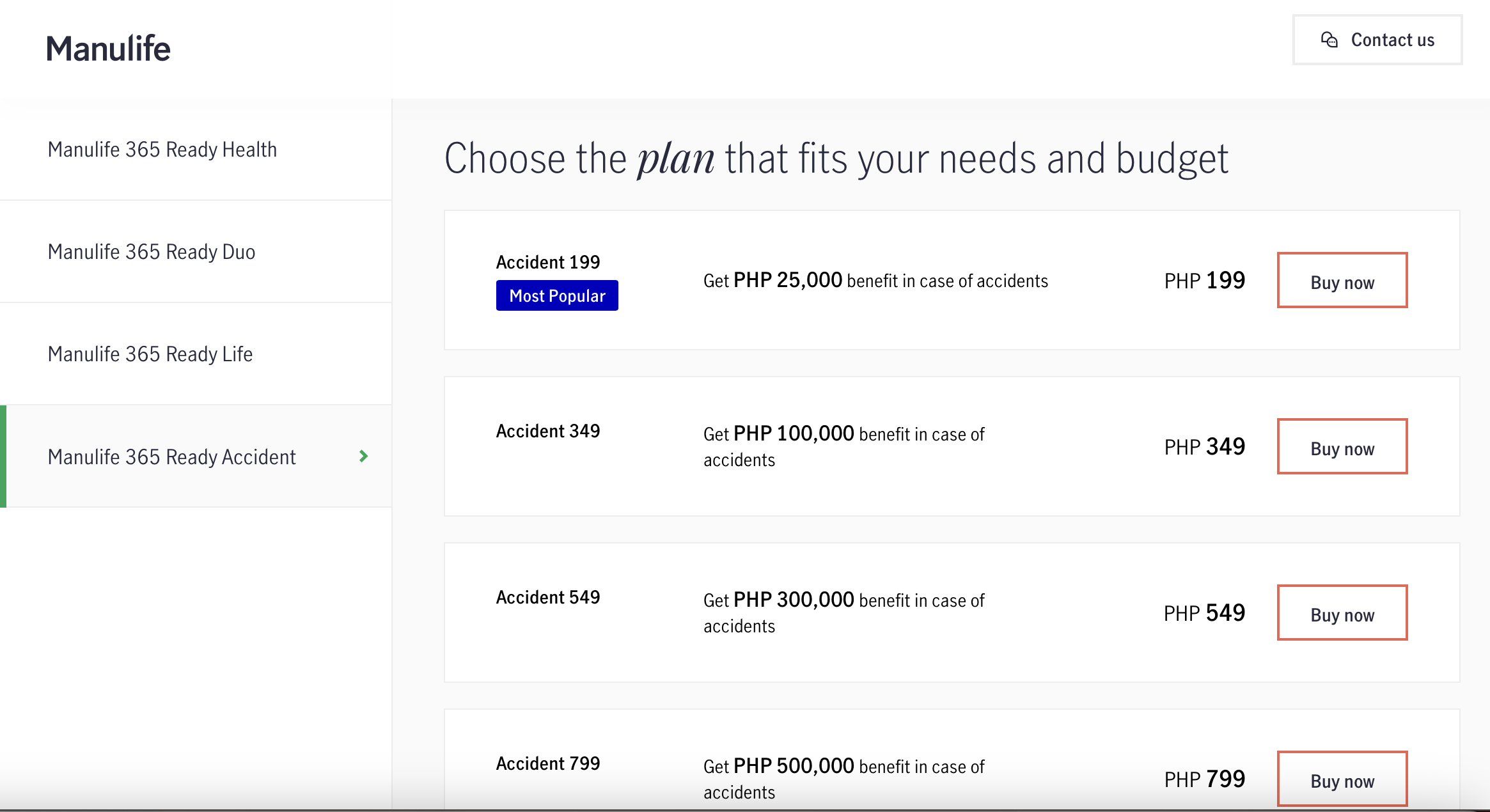

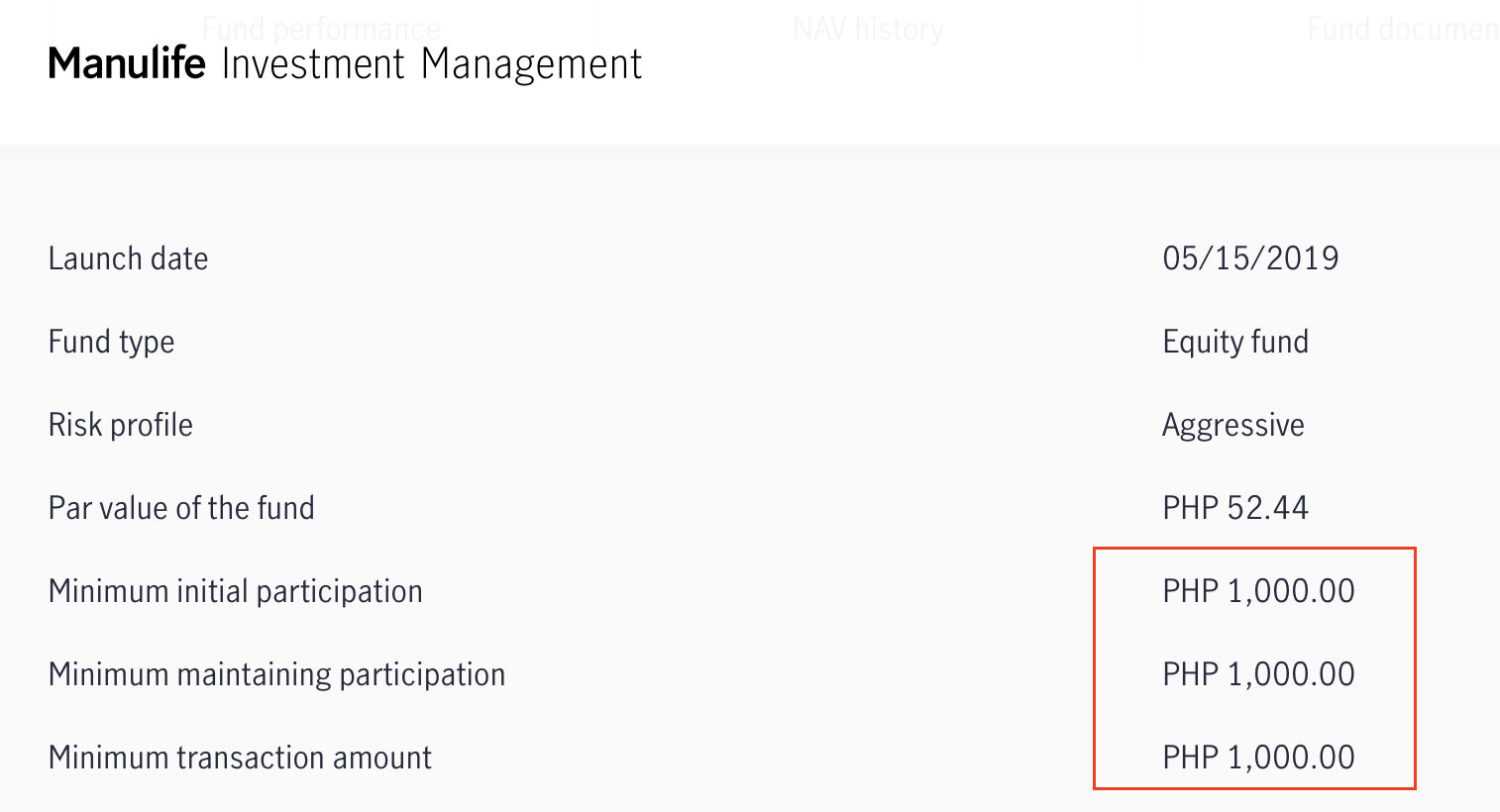

5. Very affordable products

Sometimes, some clients need insurance coverage or investment but only have P1000 to spare. The cost of living has increased recently, and sometimes budgets are tight. When looking for a company to become a financial advisor, consider the prices of the products. Does it also cater to the people who deeply need financial protection but are limited in the budget?

6. Many investment choices

Another consideration could be the number of investments clients can access through you as their financial advisor. Look for a company that allows your client to purchase investments not just in the Philippines. Their investments may also fail if the Philippine economy or political situation is not doing well. Consider companies that allow you to invest in America, Asia, Europe, China, Hong Kong, or in certain sectors such as Tech Companies, Healthcare Companies. Also, the new trend is sustainable investing, where investors prefer to invest in companies that produce minimal carbon or take care of the environment.

7. Long maximum age coverage

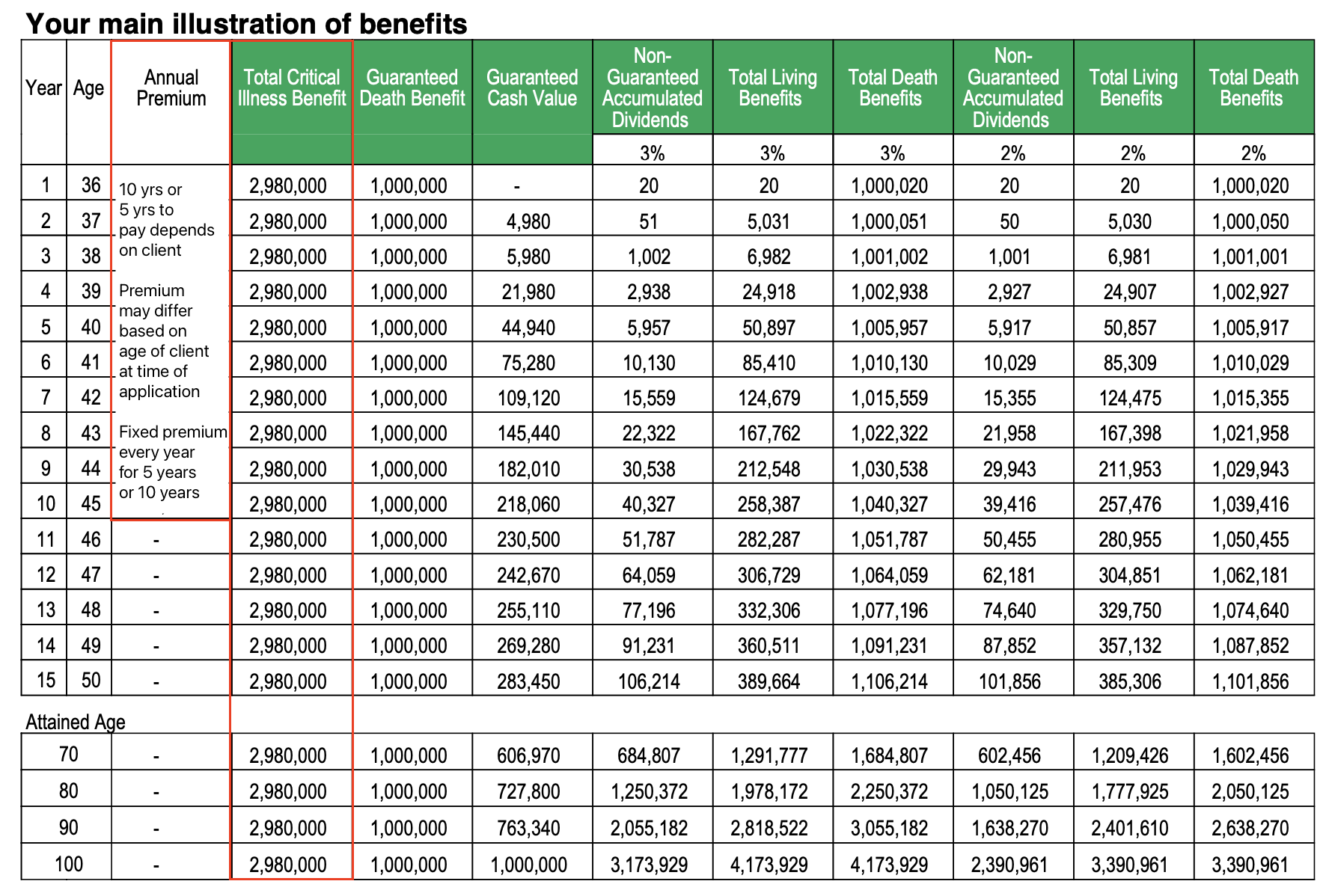

When choosing a company to be a financial advisor, also consider the maximum age the insured can be covered. For example, some insurance companies only cover until age 70 for their critical illness health coverage. Some companies offer until age 100 for their health coverage.

The first two items discuss considering which insurance company you can be part of. The next two will focus on considering which team to belong with.

Why is choosing a team equally important as choosing an insurance company? Because the team you are part of influences most of your actions and decisions. In playing basketball, team performance greatly affects individual performance. That is the same in insurance. Most of the time, the people you associate with impact your behavior, decisions, and performance.

8. Vision and Mission

Vision is the direction in which the team wants to go. If you are an achiever, you must associate yourself with a group with a vision of success for their future. A team without a vision is like a lost sheep without a direction.

Mission, on the other hand, is the purpose of being. You must be part of a team who works for a common purpose. Look for a team that has a purpose to serve people and make society a better place.

9. Values

Lastly, values are fundamental in choosing the team that best suits you. All teams have shared values and beliefs. Opposing values among team members can cause your team to go down. Worst, a team with no values at all can cause unhealthy competition. There will be no sharing of ideas because people are just concerned with their own success. Hence the team you are part of must have core values that resonate with your personality. Nothing beats a team with principles and values.

Achiever, Enthusiastic, Trustworthy, Outstanding, and Smart are the core values that we hold dearly in our team. It serves as our manual for making critical decisions.

These simple guides can help you choose which insurance company or team is the best for you. If you wish to try to become a financial advisor, the first step is to take the Are you fit to be a financial advisor quiz below.

ABOUT THE AUTHOR

Mark Fernandez, CPA, RFC, AFA, CWP, CEPP started as an insurance agent/financial advisor right after graduation at age 22 while working as an auditor at SGV&Co (Ernst & Young). He worked as a part-time financial advisor for six months before going full-time. Despite having no insurance background or connections, he became a Million Dollar Round Table member (MDRT) at age 23 due to his perseverance to learn more about the world of investing and insurance. He is currently a life (at least 10 years MDRT) and qualifying member of the MDRT and is a 2022 Top of the Table Member. He is the founder of Aetos Financial Insurance Agency Inc, which has its head office in Makati. Aetos was the Top 1 in terms of FYP and Top 5 in APE in life insurance agency rankings nationwide in 2021. Currently, Aetos has operations and financial advisors in Luzon, Visayas, and Mindanao. He is currently completing his master’s degree at the Asian Institute of Management. You may reach us by calling Aetos Financial Office Landline at 02-8789-9128 or contacting our Hotline at 0905-FINANCE or 0905-3462623.

Mark Fernandez, CPA, RFC, AFA, CWP, CEPP started as an insurance agent/financial advisor right after graduation at age 22 while working as an auditor at SGV&Co (Ernst & Young). He worked as a part-time financial advisor for six months before going full-time. Despite having no insurance background or connections, he became a Million Dollar Round Table member (MDRT) at age 23 due to his perseverance to learn more about the world of investing and insurance. He is currently a life (at least 10 years MDRT) and qualifying member of the MDRT and is a 2022 Top of the Table Member. He is the founder of Aetos Financial Insurance Agency Inc, which has its head office in Makati. Aetos was the Top 1 in terms of FYP and Top 5 in APE in life insurance agency rankings nationwide in 2021. Currently, Aetos has operations and financial advisors in Luzon, Visayas, and Mindanao. He is currently completing his master’s degree at the Asian Institute of Management. You may reach us by calling Aetos Financial Office Landline at 02-8789-9128 or contacting our Hotline at 0905-FINANCE or 0905-3462623.

What do you want to do next?

Aetos Financial