Share Now

As parent, it is our dream to be able to support our children on whatever they want to be in the future. All we want for them is to have a solid future – a kind of future built with hopes and dreams. However, many of us are clueless as to where we should start.

Being in the financial service industry for more than 9 years, there are some things that I have learned that helped me prepare for my daughter’s future. Here are some tips that I and my husband personally did to prepare for our child’s future/her future:

- Unify Points of View Used

With the rise of online shopping, we are bombarded with a lot of temptations. As a mom, it is very tempting to add to cart cute items for babies. But it is only after you purchase these cute items when you realize that your baby doesn’t actually need them. Hence, my husband and I decided not to buy things that are unnecessary and extravagant. We seldom buy toys for our baby. When we buy her clothes, we make sure that she will be able to use it for a very long time.

Babies won’t actually know whether you bought an expensive item for them or not. They have simple joys in life that even a small box from your purchases made as a toy can already make them happy. So as parents, we can allot the money that we use to buy unnecessary objects for things that can be beneficial for them in the future like books and savings for their education.

- Save for their education now

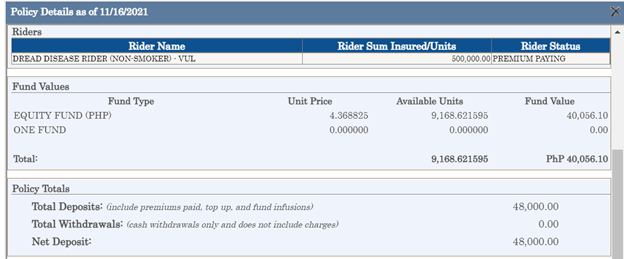

The cost of going to college in 10 or 20 years from now can double or triple than that of the cost today. This is very alarming for us, especially to my husband and I who both value education so much. We want to give our daughter options as to the course she wants to take and the school she wants to go to. To be able to do this, we need to prepare now. So, we decided to get a Variable Universal Life Insurance (VUL) plan for her days after she was born. We are very happy with what we have since this only costs us P2K per month.

Our mindset is that we are just advancing the tuition fee that we will pay in the future. Better to start paying now when we are still able to do so and our business is still doing well because we do not know what will happen in the future.

Her policy is now on its second year, and we are so happy that we were able to already accumulate 40,056.10 pesos for her education fund (not to mention the added benefits that she got aside from the fund value like life insurance and critical illness insurance):

- Secure yourself

We dream that we will always be there for our children. However, we are not sure of what will happen in the future. We hope that no accident or illness will hit us. But, if something does, we need to be ready. That is why my husband and I have insured ourselves with sufficient amount of coverage so that in case something happens to us like premature death or illness, our daughter will not have problems in pursuing her college degree. This is a legacy that we want to leave her.

We hope that these 3 simple tips can help you prepare for your child’s future. If you are interested to learn more about the educational funding that we took for our daughter, get in touch with us. We will be glad to answer all your questions.

What do you want to do next?

Aetos Financial